Introduction

Letters of Credit (L/Cs) are essential economic devices in Global trade, supplying stability and assurance to functions associated with cross-border transactions. Amid the varied sorts of L/Cs, confirmed, transferable, and standby L/Cs Participate in unique and important roles in facilitating trade.

Understanding Different Types of L/Cs

Confirmed L/Cs

A confirmed L/C is one particular the place an middleman bank (frequently in the exporter's region) provides its promise of payment to that of the issuing bank (while in the importer's place). This additional ensure offers additional security towards the exporter, lowering challenges connected with Intercontinental transactions.

Transferable L/Cs

Transferable L/Cs make it possible for the original beneficiary (the exporter) to transfer all or part in their legal rights to another provider or subcontractor. This versatility is especially valuable in sophisticated source chains where by many get-togethers are involved with manufacturing and delivering merchandise.

Standby L/Cs

Contrary to standard L/Cs, standby L/Cs mainly function a payment ensure and therefore are only used Should the importer fails to meet their payment obligations. They are often used in superior-value contracts or when extra monetary protection is ideal.

Importance of L/Cs in Worldwide Trade

Safety and Assurance

L/Cs present critical financial security in international transactions. As an example, a machinery exporter in Germany may require a verified L/C for an important get from The usa. This L/C makes sure the exporter will be paid, whether or not the importer encounters money challenges.

Facilitating Sophisticated Transactions

Transferable L/Cs are notably handy in transactions involving many suppliers or subcontractors. For instance, a textile manufacturer in India could transfer part of the L/C to the raw material provider, making certain payment at each volume of the provision chain.

Risk Administration

Standby L/Cs Perform an important part in managing economic dangers. They work as a safety Web, guaranteeing the exporter is compensated In the event the importer defaults. This guarantee is important for top-worth transactions or unsure buying and selling environments.

Implementation Technique of L/Cs

Key Ways

Agreement Negotiation: The customer and seller concur within the terms with the transaction, which includes price, quantity, and supply terms.

L/C Issuance: The importer's financial institution issues the L/C in favor of your exporter, based on the agreed terms.

Cargo of Goods: The exporter read more ships the products According to the contract terms.

Doc Presentation: The exporter offers shipping together with other required documents to their bank.

Payment Processing: Upon doc verification, the exporter's bank procedures the payment.

Contributors

Important players involved in L/C transactions include things like:

Exporters and Importers: The first get-togethers engaged within the trade transaction.

Banking companies and Money Establishments: They offer the money instruments and expert services needed to facilitate the transaction.

Insurers: They offer supplemental assures to protect non-payment hazards.

Problems Related to L/Cs

Regulatory Compliance

Navigating the complicated regulatory surroundings of international trade necessitates meticulous setting up and comprehension. Compliance with varied legal frameworks throughout nations around the world is often difficult.

Hazard Assessment

Examining the creditworthiness of international companions and dangers such as political instability and currency fluctuations are significant problems in managing L/Cs.

Technological Integration

Adopting digital methods in conventional L/C processes is usually sophisticated. However, technological improvements are important for maximizing efficiency and transparency.

Affect of Technology on L/Cs

Digitization

Technological breakthroughs are profoundly transforming the landscape of L/Cs. Automation, artificial intelligence, and blockchain know-how now play a important purpose in maximizing performance and transparency. These progress are revolutionizing how trade finance businesses operate, in the end benefiting all stakeholders concerned.

Efficiency Gains

Digital platforms and fintech options allow more rapidly usage of funding. On the net portals allow for businesses to submit an application for trade finance products effortlessly, though AI-driven analytics aid assess credit history chance far more precisely. These enhancements permit trade finance companies to raised cater on the requirements of diverse clients.

Summary

Confirmed, transferable, and standby L/Cs are necessary equipment in international trade, furnishing the security and adaptability needed to aid cross-border transactions. By knowing their workings and importance, corporations can much better navigate the complexities of Intercontinental trade and seize development alternatives.

Regularly Questioned Concerns (FAQs)

What exactly is a verified letter of credit history?

A confirmed letter of credit can be an L/C in which an middleman lender provides its payment warranty to that from the issuing bank, delivering added safety to the exporter.

Why are transferable L/Cs critical?

Transferable L/Cs allow the exporter to transfer their rights to other suppliers or subcontractors, facilitating elaborate transactions in offer chains.

Exactly what is the role of standby L/Cs?

Standby L/Cs serve as a payment assure and are utilized only in case of importer default, supplying enhanced financial security.

So how exactly does technological know-how effect L/Cs?

Technological know-how boosts L/Cs by introducing digital answers, AI, and blockchain, rising the performance and transparency of transactions.

What worries are connected with L/Cs?

Challenges contain regulatory compliance, assessing the dangers of Global associates, and integrating technological answers into traditional processes.

External Backlinks

Introduction to Letters of Credit history

Explanation of Global Letters of Credit history

Introduction to International Trade Finance

Inner Linking Opportunities

Url to similar articles or blog posts on your internet site talking about specific trade finance instruments like letters of credit score or financial institution ensures.

Connect with case scientific studies showcasing productive trade finance apps.

Reference web site posts about latest technological enhancements in trade finance.

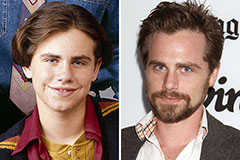

Rider Strong Then & Now!

Rider Strong Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!